As CU-Boulder freshmen finish their first year, it’s the perfect time to start thinking about housing for the upcoming school year.

August will be here before you know it—and with it, the annual rush of students returning to town. That rush always brings a surge in real estate activity, especially in Boulder’s tight rental market. Because of this, many families consider buying a home or condo for their student to live in while attending school. It’s a practical move, and timing is everything. Since closing on a property typically takes 30 to 60 days, NOW is an ideal time to begin your search.

Beyond the immediate benefits of stability and comfort, purchasing college housing can be a smart long-term investment. In Boulder, for example, a condo purchased in the 1980s and held for four years likely sold for about the same price it was bought for. But since 2012, condos held for just four years have often appreciated enough to cover in-state tuition at CU. In 2025, there’s a bit more inventory on the market—meaning the perfect place could be waiting right now for your student’s next three years.

Why Buying Housing for Your College Student Can Be a Smart Move:

Owning a property your student lives in during college can offer significant advantages—both financially and personally. For starters, it provides stability. Instead of scrambling for a new rental each year, your student can settle into one place for the duration of their college experience. You also get the benefit of choosing a location and home environment that supports their academic and personal success. Rent in college towns tends to rise annually, but with a fixed-rate mortgage, your student’s housing costs remain predictable. You’ll avoid the cycle of security deposits and move-in hassles, and you won’t need to worry about storing furniture over summer breaks. Plus, owning a home offers an invaluable learning opportunity—your student will gain firsthand experience in real estate, budgeting, and the responsibilities of property ownership.

From my own experience: both of my sons attended the University of Colorado. I purchased condos for each of them using owner-occupied FHA financing. They each lived in their unit and had roommates whose rent helped cover the mortgage. By graduation, they had not only a college degree—but also real estate equity to launch the next chapter of their lives. Some of my clients have taken this approach even further, purchasing a single property where all of their children lived during their college years—sometimes spanning a full decade. Instead of spending tens of thousands on rent, they built equity in a long-term investment.

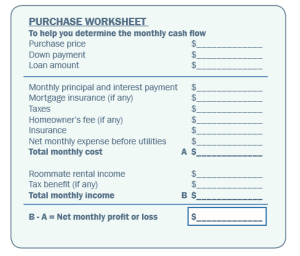

Here’s a simple worksheet to help you determine the month-to-month expenses for owning a condo or house for your college student while you evaluate if this is the right decision for your family.

In my next article,

Part 2—Now is the Perfect Time to Buy College Housing,

I’ll share a practical checklist to help you evaluate whether purchasing a condo or house for your college student is the right move—and how to plan for it effectively.

__________

Duane graduated with a business degree and a major in real estate from the University of Colorado in 1978. He has been a Realtor® in Boulder since that time. He joined RE/MAX of Boulder in 1982 and has facilitated over 2,500 transactions over his career. Living the life of a Realtor and being immersed in real estate led to the inception of his book, Realtor for Life. For questions, email duaneduggan@boulderco.com, or go to BoulderPropertyNetwork.com.